Understanding which office space to use for your business can be a huge factor in your financial success. After all, rent is one of the biggest expenses faced by many

Read More

The total number of university graduates increases each year, as more and more students choose to partake in higher level education Conversely, this means many more interns flooding the market:

Read More

Buying a business can be one of the most exciting endeavors of your life, but also one of the most challenging. We’ve noticed that these two things can often go

Read More

Graphic designers are a powerful force in making a difference between your business and your competition when customers search for you. When you have brand new prospects arriving on your

Read More

In the business world, knowledge is power: and there’s no knowledge more powerful than knowing your customer. Truly understanding the ins-and-outs, the nuances, the lingo and everything else that makes

Read More

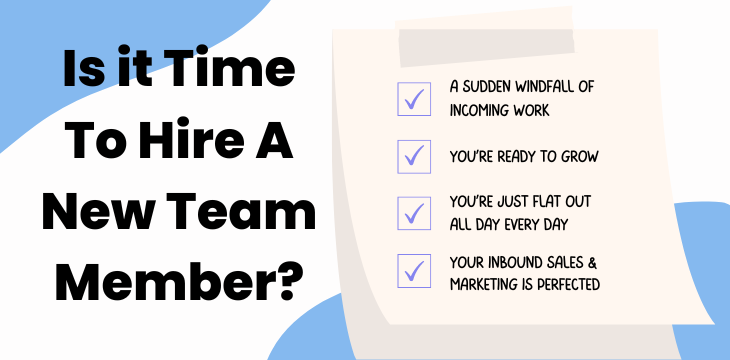

There’s one golden rule we’ve found applies to all businesses: in order to grow, you must eventually hire more people! Of course, that’s not to say it’s going to be

Read More

This very second there are five completely free tools you could be using to tremendously improve your website traffic, sales and growth. How? From spying on your competitors exact ads,

Read More

Take control of your finances and apply for a PAYG income tax withholding variation (ITWV) today! With this application, you can potentially receive your investment deductions throughout the year instead

Read More

Don’t wait until tax season! Take control of your finances and secure your financial future with our expert Tax Planning Services. Seeking advice from Tax Experts can help you navigate

Read More

Want to give an extra boost to productivity around your office, but sick of seeing regurgitated LinkedIn productivity hacks? There’s certainly no shortage of conventional wisdom. But surely with the

Read More